Home buying is an important milestone in many people’s lives. For service members who move a dozen (or more!) times during a career, it can be a daunting task. Fortunately, the U.S. Department of Veterans Affairs (VA) has an amazing set of home loan benefits for eligible service members.

I set out to learn the basics, benefits, savings, and limitations of the VA home loan program, which makes owning a home easier for military families. Let’s discuss the law as well as loan limits, funding costs, and basic options for homeowners seeking to use the VA loan. We can also look at a sample cost savings calculation for a conventional versus a VA loan, when buying a home without a down payment.

The Law

Here are the actual rules on VA loans, and what they means for you.

Eligibility

There are three basic requirements to become eligible for a VA home loan:

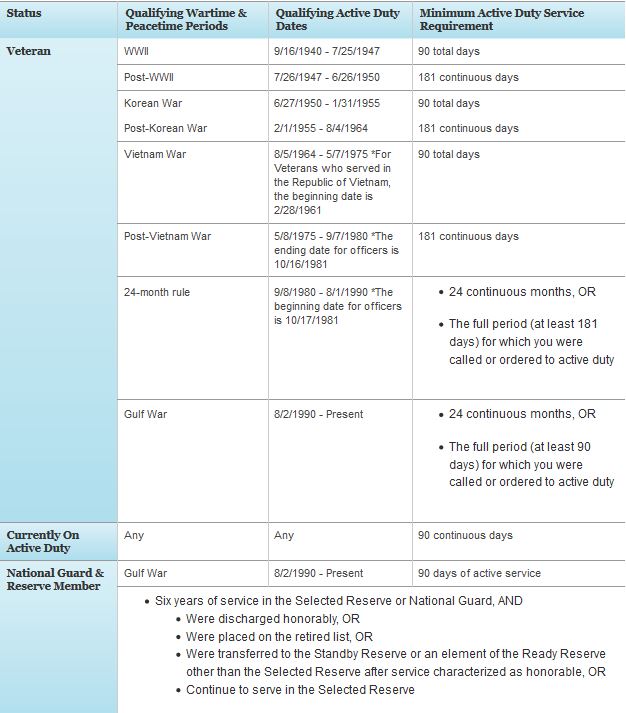

- You need to have served or be on active duty in the Armed Forces of the United States. Widows of fallen service members are also eligible under certain conditions. Reservists and National Guard members who meet the prerequisites qualify for the VA home loan. The basic time limits for qualification are 90 consecutive days of active service during wartime, 181 days of active service during peacetime, or six or more years of service in the Reserve or National Guard.

- You need to have available entitlement, which means you do not own a home financed with an active VA loan or you have not used your one-time exception (more on that later).

- You need a certificate of eligibility. This is proof that you are eligible for a VA-sponsored loan. Today, lenders have electronic access to the VA system that automatically produces this certificate for the borrower.

Entitlement

Those qualified for a VA loan have a basic entitlement of $36,000. If your prospective VA loan is larger than $144,000 – four times the basic entitlement – lenders may want a down payment on your home.

However, they usually do not. It depends on your credit history, the property appraisal versus the asking price, and your income level.