Life insurance offered through the workplace is becoming a must-have benefit, especially with small group, as business owners are thinking about benefits beyond traditional core offerings that will make their plans more attractive.

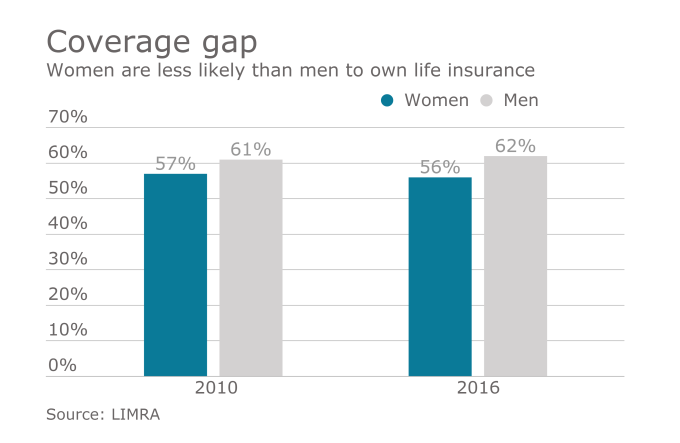

Life insurance was previously a tough sale. More than half of Americans (56%) indicated in a 2016 LIMRA study they had no plan to purchase life insurance that year, while just 25% said it was likely they would do so.

But now, more than half (57%) of employees at companies of all sizes believe life insurance is a must-have benefit, ranking seventh on the list in MetLife’s 2017 Employee Benefits Trends report, behind health insurance, prescription drug coverage, a retirement plan, auto insurance, dental insurance and home insurance, respectively.

One America, an Indianapolis-based insurer, is seeing an uptick in smaller employers offering life insurance, Steven Lynch, the company’s VP of national sales and services, says. Since the company is privately held, it has not released detailed numbers. But in very small group (under 10 lives), Lynch says it is a “substantial increase.”

One America, an Indianapolis-based insurer, is seeing an uptick in smaller employers offering life insurance, Steven Lynch, the company’s VP of national sales and services, says. Since the company is privately held, it has not released detailed numbers. But in very small group (under 10 lives), Lynch says it is a “substantial increase.”

The reason for the increase is the changing selling tactics, such as more emphasis on benefit counseling, and increased attention to financial wellness and how life insurance plays into an employee’s financial security. “Some of the recent trends are toward … consultative selling and emphasis on tying the needs of life insurance into the financial picture for employees,” says Judy Buczek, director of group products, life and disability, at Guardian Life, who reports a slight uptick in sales across all employer sizes, as well.

“The emphasis is more on financial education at the workplace. We are seeing that as a trend where employers recognize employees can benefit from financial education,” she adds. “Life insurance plays into a key part of financial wellness.”

An advisers’ role

Advisers need to be leading the conversation about life insurance and is naturally a part of financial wellness, explains Quincy Branch, president and CEO of Las Vegas-based brokerage Branch Benefits Consultants.